We help your importers to buy products and goods "Made in Germany"

We know the needs of importers

Your importers:

- Want to buy in Germany.

- Want a longterm financing.

- Need a long line of credit.

- Need liquidity.

We help your importers to buy equipment & financing in Germany!

That's why export financing is the solution for your importers

Competitive interest rate and low financing costs

- All these factors determine your competitive position.

Financing on favorable terms

- Raising funds to pay for imports and not burdening the importer's local credit lines. As a result, an attractive price level can be created.

- Cheap long-term financing: Financing costs are usually lower than local financing

Planable annual cost for up to 22 years credit period with fixed down payment

- Depending on the value of the order

Open Cover policy

- Open cover policy with no restrictions

- Support transactions from very small up to large infrastructure projects / large corp. investments

Better conditions under OECD arrangement

- Longer tenors and more flexible repayment terms will be accessible

Benefits for sustainable projects worldwide

Sustainable projects benefit from a range of attractive cover improvements under the German Export Credit Guarantees scheme. These include eligibility for up to 70 % foreign share, as long as key technologies or core competencies remain in Germany. Financing terms can extend up to 22 years, provided the risk structure and asset lifespan justify it. Local costs can be fully financed without requiring a down payment, and local currency financing is available without any additional surcharge. Furthermore, the cover ratio for political and economic risks can be increased to 98 %, enhancing financing security and competitiveness. For projects outside sector-specific guidelines, climate classification is based on standard ESG due diligence.

If you are using Internet Explorer, please switch to another browser for a correct display of the page.

The German industrial landscape offers the widest range of industries in the world!

We know what is important to your importers.

Your importers are looking for pure products and services "Made in Germany", but also for:

Efficient and reliable processes

Negotiating and drafting contracts can be difficult and challenging. An excess of bureaucracy and paperwork in addition are not helpful. Our business processes are therefore efficient and reliable.

Long-term trust in a business relationship

Good processes are based on a solid foundation of mutual trust and long-term relationships.

Practical videos - How SMEs use the advantages of Hermes cover

Get in touch with us

Let our financing experts advise you:

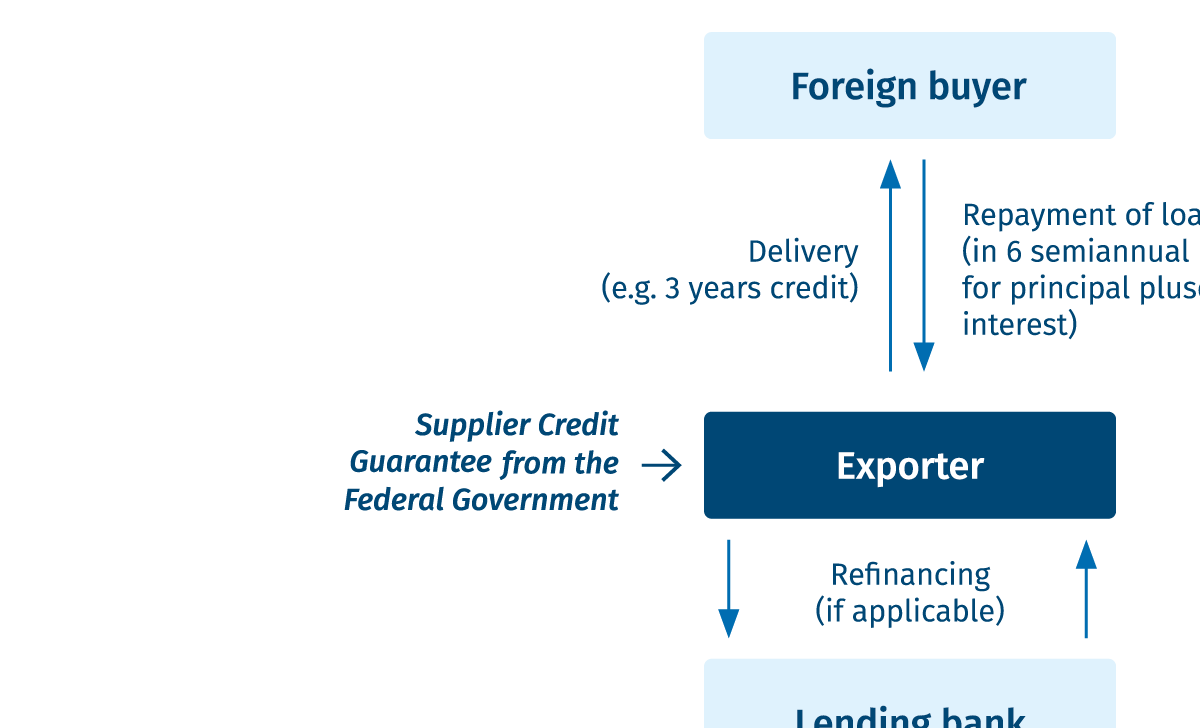

Supplier Credit

Advantages for the exporter:

- Competitive advantage

- Fast liquidity

- Balance sheet reduction

Advantage for the buyer:

- More favorable conditions compared to local financing

- Financing outside the credit line of the house bank

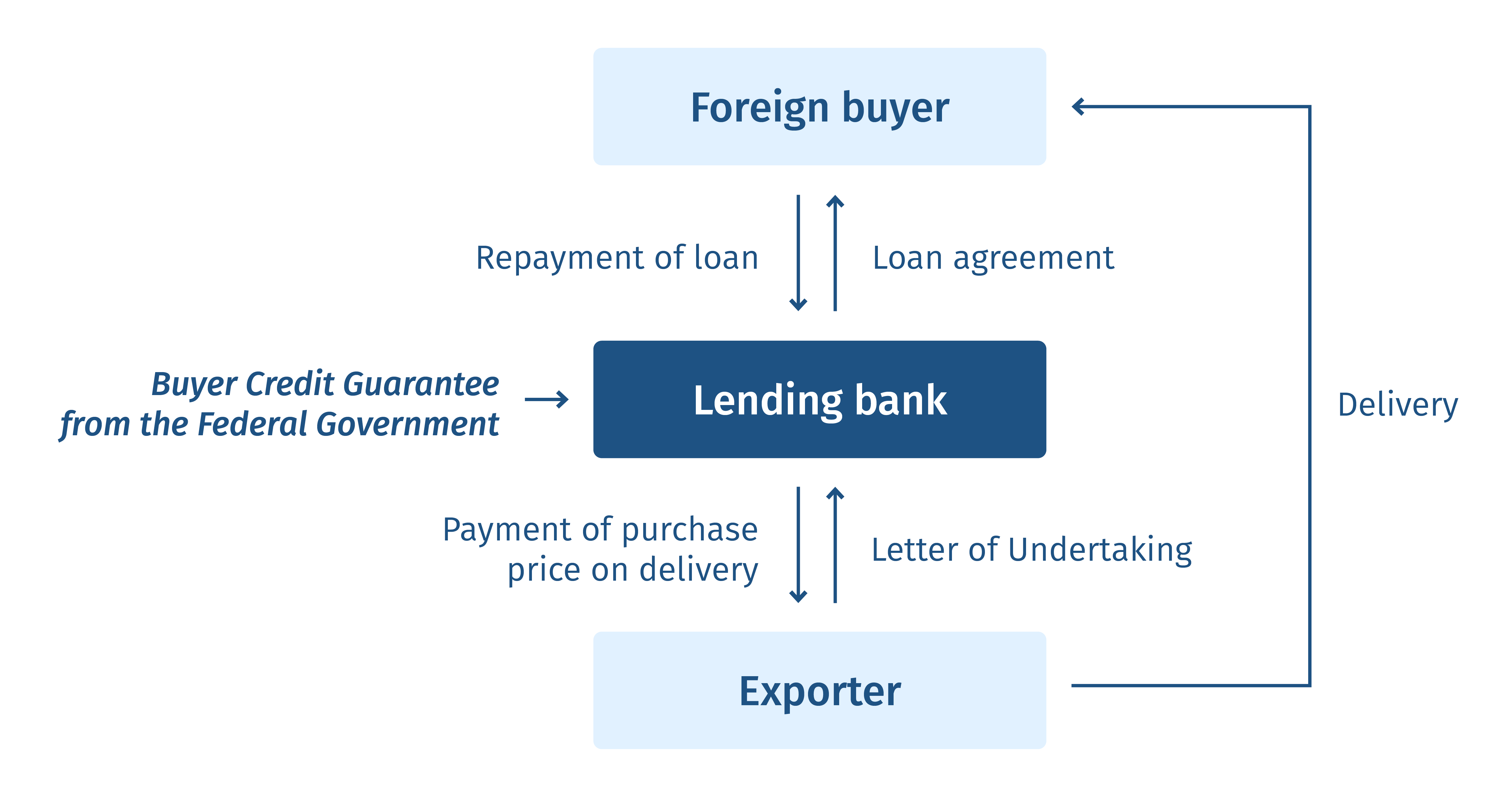

Buyer Credit

Advantages for the exporter:

- Competitive advantage

- Fast liquidity

- Balance sheet reduction

- Credit negotiation carried out by the house bank

Advantage for the buyer:

- More favorable conditions compared to local financing

Get in touch with us

Downloads

Do you have any further questions?